When Russian peasants set hearth to a whole lot of buildings in Moscow in 1648, the acute trigger was a pointy rise within the value of salt. Once they rioted once more 12 years later, it was to protest a authorities coverage that made copper cash equal in worth to cash comprised of silver—a coverage that naturally induced widespread value inflation.

A rise within the value of bread, and a clumsy authorities response to it, helped set the French Revolution on its bloody course.

Periodic violence focusing on Jews and different minority teams all through European historical past has been linked to inflation and different sources of financial instability. Probably the most notorious and horrific of these incidents, in fact, started as an try to scapegoat Jews for the spike in inflation that plagued Germany within the wake of World Struggle I. American historical past, too, is affected by panics, riots, and upheaval attributable to sudden rises in costs and the general public’s notion that they’re being ripped off. Within the early days of the American experiment, indebted Massachusetts farmers took up arms in opposition to the brand new federal authorities’s financial insurance policies. Two centuries later, dozens of farmers drove their tractors to the entrance door of the Federal Reserve in downtown D.C. to protest rising prices.

It could be tempting to dismiss the unsettling historical past that hyperlinks excessive inflation with political unrest and aggressive xenophobia. Individuals dwelling as we speak are the richest cohort of human beings ever to inhabit the planet. Certainly we’re not as inclined to the psychological results of inflation as our forebears, for whom a spike within the value of primary items is perhaps a matter of life and demise?

And but we might not be as far faraway from Russian serfs or Weimar Germans as we might wish to suppose. Simply take a look at the panicked runs on bathroom paper within the early days of the COVID-19 pandemic, and the social media–fueled outrage over final 12 months’s sharp enhance within the value of eggs. Or there’s the bipartisan political impulse to scale back worldwide commerce and restrict immigration—insurance policies that won’t cut back inflation however try to deflect blame for it onto foreigners.

Milton Friedman famously described inflation as being “all the time and all over the place a financial phenomenon.” That is nonetheless true with regards to the causes of inflation—extra money chasing the identical variety of items is a surefirerecipe for larger costs. But it surely doesn’t absolutely seize the consequences of inflation, which lecturers are nonetheless learning.

Inflation, it seems, can also be a psychological phenomenon. It makes us indignant. It makes us irrational. In any democratic system, that anger and irrationality may be rapidly translated into poor insurance policies—except elected and unelected officers are ready to resist it, and to acknowledge that combating inflation usually requires unpopular actions. Now just isn’t the time to indulge the knowledge of the mob.

Briefly, inflation breaks our brains. It makes us poorer, and poorer residents too.

‘Paying Them With out Mercy’

Inflation has been a set off for political and social unrest for so long as America has had its personal paper cash.

The nation’s first inflation incident occurred whereas the Revolutionary Struggle was ongoing, based on Carola Binder, the chair of the Haverford School division of economics and the creator of a brand new e book, Shock Values: Costs and Inflation in American Democracy,which examines the interaction between rising costs and politics. The fledgling American authorities issued paper cash, often called “continentals,” to fund the conflict effort, however the payments had been seen as being principally nugatory. Consequently, inflation occurred.

“Inflation meant that debtors may repay their money owed in depreciated forex, which in fact infuriated their collectors,” says Binder. “The massive drawback was that collectors had been compelled to just accept the Continentals in compensation for money owed, regardless that the worth of the Continentals had fallen.”

John Witherspoon, one of many signers of the Declaration of Independence, dryly famous the humorous outcomes. Somewhat than lenders pursuing debtors to hunt compensation, he wrote, collectors had been “working away from their debtors, and the debtors pursuing them in triumph, and paying them with out mercy.”

A postwar interval of deflation—through which costs truly fell—left some farmers unable to promote meals at excessive sufficient costs to make funds on their mortgages. That triggered Shays’ Revolt, a violent Massachusetts rebellion in 1786 and 1787. “The military ultimately quashed the rebel, nevertheless it positive made an affect,” says Binder. “It confirmed the framers of the Structure that value fluctuations affected not solely the financial but additionally the political and social well-being of the states and the union.”

A lot of the primary 100-plus years of U.S. historical past is marked by that very same sample of inflation and deflation, together with the corresponding panics, bankruptcies, booms, and busts. Every shift within the worth of cash triggered requires political motion, usually within the type of protectionist schemes like tariffs or direct political intervention within the financial system to set costs.

When the Federal Reserve system was created in response to the Panic of 1907, the brand new central financial institution was given a mandate to maintain costs secure. In concept, that might take away the levers of financial coverage from American politicians, who had for many years used these powers to affect elections, reward associates, and punish enemies.

The Federal Reserve’s primary instrument for combating inflation is the power to lift rates of interest. Greater rates of interest make it marginally extra enticing to save cash moderately than spend it, so dialing up rates of interest can cut back the sum of money circulating within the financial system and thus ease inflation.

In fact, individuals do not like larger rates of interest both. When the Federal Reserve raised rates of interest to fight inflation in 1980, homebuilders mailed lengths of lumber to Chairman Paul Volcker’s workplace as a type of protest, since larger rates of interest made it harder for Individuals to afford properties (as is occurring once more as we speak). Dozens of farmers staged a protest exterior the Federal Reserve’s headquarters in Washington. “They wished a normal decreasing of rates of interest. In addition they wished the charges on loans to farmers lowered just a little greater than the remaining,” The Washington Publish reported on the time.

That interaction between inflation and rates of interest is important to the Federal Reserve’s mandate. It is also important to understanding why so many Individuals report being sad concerning the state of the financial system as we speak, regardless that inflation has fallen a good distance from its mid-2022 peak and unemployment stays close to historic lows.

One thing Lacking

The official story of inflation within the early 2020s is well-known. There was a pandemic, and the federal government response in any respect ranges was unprecedented. Companies closed, unemployment briefly skyrocketed, and stimulus spending of borrowed {dollars} reached beforehand unimaginable heights. Provide chains had been severely confused. Shopper conduct shifted seemingly in a single day. Trillions of {dollars} in financial intervention spiked demand and, most significantly, meant that abruptly there was much more cash sloshing round within the financial system. Costs, naturally, rose rapidly—and saved rising.

Throughout the 12 months that resulted in June 2022, client costs in america climbed by 9.1 %, based on the Division of Labor. It was the best inflation price recorded in additional than 40 years—and even that statistic fails to seize simply how irregular of an financial occasion this was.

Earlier than 2021, the final full 12 months through which America skilled a median inflation price of greater than 4 % was 1991. There was solely a single 12 months (2008) from then by means of 2020 when the annual inflation price exceeded 3 %. Throughout peak inflation within the first half of 2022, the worth will increase had been two to 3 instances worse than the worstbout of inflation that the majority Individuals may simply recall.

It additionally signifies that regardless that inflation has fallen considerably since its mid-2022 peak, the present price of three % (in June 2024) remains to be excessive by latest historic norms. It is also nicely above the Federal Reserve’s official goal price of two %.

Shoppers are nonetheless feeling the sting. An annual survey of Individuals’ financial opinions launched in Might discovered that inflation was the highest fear for a 3rd 12 months in a row. Apparently, the variety of Individuals who named inflation as their high concern has grown (from 35 % in 2023 to 41 % this 12 months) even because the inflation price has fallen. It dwarfs different points: “The price of proudly owning or renting a house” ranked second at simply 14 %.

Inflation has fallen, however Individuals are extra nervous about it than two years in the past when it was working 3 times as excessive—and extra prone to view the financial system as an entire in a adverse gentle. How can this be?

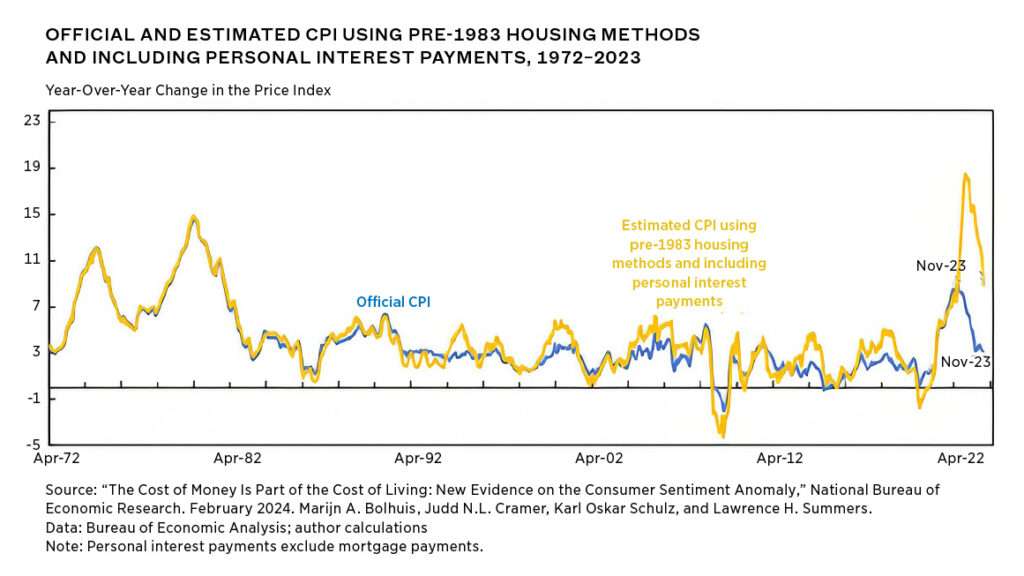

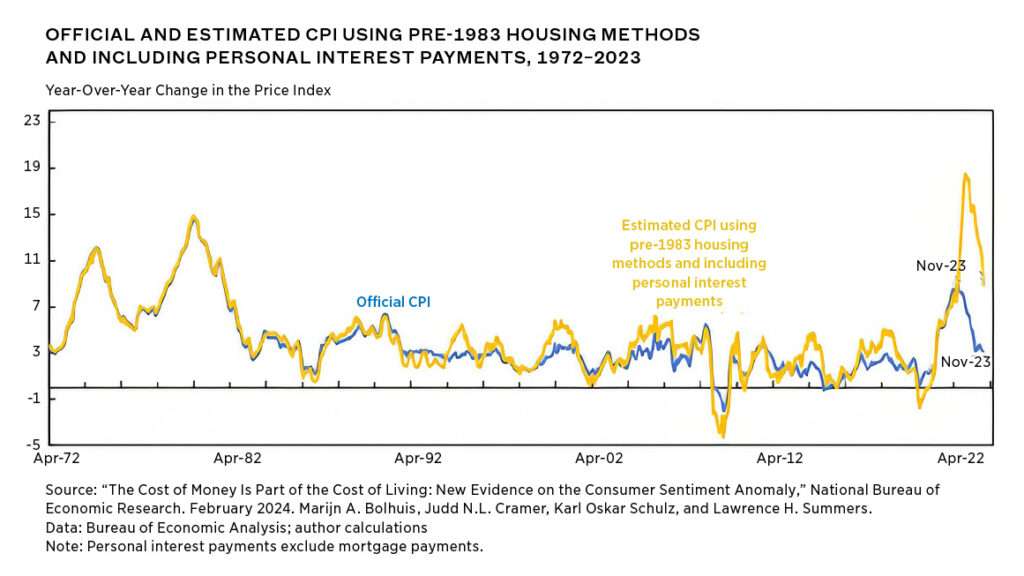

“We suggest that borrowing prices, which have grown at charges that they had not reached in a long time, do a lot to elucidate this hole,” argue economists from Harvard and the Worldwide Financial Fund in a February 2024 working paper. The 4 authors, together with Obama administration financial adviser Lawrence Summers, write that “considerations over borrowing prices…are at their highest ranges” because the early Nineteen Eighties.

To fight rising costs, the Federal Reserve raised its baseline rate of interest 11 instances from March 2022 to July 2023 in an try to curb rising costs. In whole, the central financial institution has raised its baseline rate of interest from close to 0 to over 5 %, and people adjustments have filtered into the financial system within the type of larger borrowing prices for anybody who wants a automotive mortgage, a mortgage, a enterprise mortgage, or another type of debt.

However larger rates of interest aren’t taken under consideration within the authorities’s official inflation calculation, often called the Shopper Worth Index (CPI). To know why that is vital, Summers and his three co-authors level to the method for purchasing a brand new automotive. The price of new and used automobiles is weighted to account for roughly 7 % of the month-to-month CPI, however the price of financing a automotive just isn’t included in any respect, regardless that greater than 80 % of all automotive purchases are made with a mortgage.

The identical drawback pops up if you take a look at housing. The month-to-month mortgage cost on the median-priced residence in america has climbed from $1,621 in 2020 to $2,722 in July 2024. Sure, housing costs have elevated throughout that point, however not sufficient to account for that 68 % enhance. The larger issue—one that doesn’t get included within the official CPI metrics, regardless that it makes a giant distinction to a possible homebuyer—is the rise in rates of interest.

The paper’s authors calculate that if the pre-1982 inflation metrics had been getting used as we speak, the speed of value will increase would have peaked at an astonishing 18 % in June 2022 moderately than 9.1 %. In November 2023, the latest month that the paper covers, inflation would have rung in at 9 % as an alternative of barely over 3 %.

It is not simply that the cash in your pockets is value much less. The cash you do not have—the quantity you would possibly must borrow to make a giant buy like a house or automotive—is now additional out of attain.

Having the ability to afford a mortgage or a automotive mortgage is “integral to American shoppers’ sense of their financial well-being however their value just isn’t included in official inflation measures, it’s no surprise that sentiment lags conventional measures of financial efficiency,” the 4 economists write. “Shoppers are together with the price of cash of their perspective on their financial well-being, whereas economists should not.”

And if inflation is worse than the official numbers would counsel, that is probably a worrying signal for quite a lot of different social indicators too.

Information and Emotions

If there is a silver lining to three-plus years of rising costs, it is that wages have been rising throughout the board too—and after the preliminary inflation surge in 2022, pay will increase have truly outpaced the official inflation numbers. In reality, the Congressional Finances Workplace reported in Might that common wages have grown sooner than inflation in any respect revenue ranges since 2019. President Joe Biden has touted rising wages as a part of the White Home’s messaging technique aimed toward convincing Individuals the financial system is doing nicely.

In fact, the wages-are-growing-faster-than-prices argument would not embrace the toll that larger rates of interest have taken.

Regardless, it looks as if Individuals’ emotions do not care a lot about these info.

New analysis from Harvard economist Stefanie Stantcheva reveals that human beings are merely much less prone to acknowledge the potential advantages of inflation—larger wages, chief amongst them—and can as an alternative deal with the negatives. For her aptly titled paper “Why Do We Dislike Inflation?” Stantcheva interviewed greater than 2,000 individuals. She concludes that the majority respondents consider wage will increase are resulting from their on-the-job efficiency, whereas they view inflation as being responsible for his or her paychecks not stretching so far as earlier than.

The larger drawback is that Individuals do not see inflation as “a mere ‘yardstick’ or a unit of measure,” Stantcheva writes. As a substitute, “people anticipate quite a lot of tangible hostile results on each their private monetary scenario and the financial system at giant.”

That stress and uncertainty rapidly turns into one thing else. In Stantcheva’s survey, 48 % of respondents had been “indignant” about inflation. This anger may be expressed in haphazard methods, although the commonest responses are about what you’d anticipate if you happen to’ve spent a lot time speaking to individuals or scrolling by means of social media lately.

“The commonest [target] is Biden and the administration (‘I feel it has to do with Joe Biden’, ‘Joe Biden’s insurance policies for this spherical of inflation’) adopted by Greed (‘I consider the only motive is grasping companies who care extra about their backside line than truly serving to individuals’),” Stantcheva studies.

In the meantime, simply 13 % of high-income respondents and solely 3 % of low-income earners blame financial coverage. General, 18 % of respondents blamed Biden and 10 % blamed “greed,” however low-income respondents are way more prone to blame the president (22 % of them do) than high-income earners (12 %) are.

Fears concerning the penalties of inflation additionally lengthen past the financial realm and into metapolitics. Near three-quarters of all respondents in Stantcheva’s survey say inflation will harm America’s worldwide popularity and can lower political stability at residence. These forms of worries can grow to be self-fulfilling—or can provide voters an incentive to embrace radical alternate options.

Having a lot of individuals indignant about their declining dwelling customary, even (or maybe particularly) if they do not absolutely perceive the underlying trigger, looks as if a method for broader discontent. Historical past, and Stantcheva’s analysis, suggests many individuals will probably be searching for somebody responsible.

For giant sections of the voters, immigrants appear to be a probable scapegoat. An annual Gallup survey launched in July confirmed that 55 % of Individuals wish to see immigration to the U.S. decreased. For many years, that determine had been regularly declining, and the inflection level strains up nearly precisely with the acceleration of inflation. In Might 2020, Gallup discovered simply 28 % of Individuals favored much less immigration. That quantity climbed to 38 % in 2022, 41 % in 2023, after which jumped once more in 2024.

Actually, anti-immigrant political rhetoric has been a characteristic of right-wing politics since nicely earlier than the present bout of upper inflation. Gallup’s numbers counsel one thing has modified prior to now 4 years, nevertheless, and that argument is now connecting with a a lot bigger viewers.

“With out absolutely understanding inflation’s financial roots, we are able to all mistake the signs for its trigger,” says Ryan Bourne, a Cato Institute economist who edited the latest e book The Struggle on Costs.

Bourne says “surprising inflation creates battle” and warns that frustration about inflation can result in “blaming malevolent actors or exterior forces, and moralizing about individuals’s self-interested conduct.”

Although the contours of these conflicts have differed all through historical past, it appears unwise for officers to disregard the ways in which ongoing higher-than-normal inflation can stress our already overheated political system. If you wish to safeguard democracy, one of many high agenda gadgets ought to be limiting inflation.

Sadly, that has not been on the high of the agenda.

Who Will get the Blame?

It is solely honest to pause for a second and level out that nobody actively selected this end result.

Presidents should not singularly liable for every thing that occurs to the financial system whereas they’re in workplace. There isn’t any toggle change on the aspect of the Resolute desk to extend inflation or wages, simply as there is no such thing as a button for low gasoline costs or full employment. This has all the time been true, underneath Biden and Trump and all who got here earlier than them, and will probably be true when somebody new will get to the Oval Workplace.

And but, each Trump and Biden should bear some accountability for all this. At almost each flip, the 2 most up-to-date presidents repeatedly made decisions that heightened the chance of accelerating inflation. As soon as the chance materialized, Biden has taken steps to worsen it, Trump has promised to pursue comparable measures, and each have sought to stoke standard discontent for political acquire. Neither appears to have a lot in the best way of an answer.

Begin with Trump. In simply 4 years, he oversaw greater than $8 trillion in new borrowing. In doing so, he and his fellow Republicans did not simply reveal that their Obama-era criticism of excessive spending was unserious. In addition they ignored a pile of financial proof that enormous debt-to-GDP ratios are likely to nudge inflation larger, and to make it more durable to regulate as soon as it hits.

When COVID-19 arrived, Trump pushed for and signed two multitrillion-dollar spending payments that included quite a lot of gadgets prone to enhance inflation—resembling direct funds distributed to many American households no matter whether or not they’d suffered any financial hardship from the pandemic.

Then got here Biden. Not lengthy after taking workplace in January 2021, his administration made a option to pursue what Bloomberg termed “run-it-hot economics,” which included the $1.9 trillion American Rescue Plan and the distribution of one other spherical of stimulus checks. Though some economists, like Summers, warned that extra borrowing risked tipping the financial system into an inflationary cycle, the White Home had vital help in mainstream, liberal establishments for cranking the spigot wider. Neil Irwin, then The New York Instances‘ senior economics correspondent, wrote that a very powerful lesson for the incoming administration was the truth that “a ‘scorching’ financial system with excessive deficits did not trigger runaway inflation.”

After which it did.

Now What?

When inflation peaked at varied different instances in American historical past, Binder says, the political system has struggled to reply. The identical has occurred prior to now few years.

“We noticed the Biden administration blaming inflation on [Vladimir] Putin and company greed, as a result of they did not need tighter financial coverage which may danger a recession or larger unemployment,” she says. She additionally notes that points that often popped up throughout inflationary durations within the nineteenth century have returned. The political proper desires to hike tariffs. The left is concentrated on utilizing antitrust legal guidelines to interrupt up large companies and by some means fight greed itself.

None of that’s prone to decrease inflation in a significant manner, due to course it’s a financial phenomenon—thanks, Milton Friedman. However ready for inflation to ease by itself or substituting the squeeze of upper costs for the pinch of upper rates of interest just isn’t a satisfying resolution for most individuals. The voters demand that the politicians do one thing, and those that wish to get reelected really feel the urge to attempt.

That is what is lacking in Stantcheva’s survey, says Binder, who reviewed the paper earlier than it was revealed. “Despite the fact that individuals report disliking inflation on her survey, they usually do like, and push for, insurance policies which might be inflationary—like expansionary financial coverage (low rates of interest) and financial stimulus,” Binder says.

Officers ought to resist requires inflationary insurance policies in the midst of an inflationary interval. Sadly, inflation breaks individuals’s brains—and politicians are individuals too.

Inflation is likely one of the defining elements of the election season. Biden’s “run-it-hot economics” was the achievement of a marketing campaign promise to ship extra stimulus—and to ship extra checks to American households, a coverage concept that unsurprisingly polled extraordinarily nicely when it was tried in the course of the pandemic. When that was now not tenable, Biden and Congress handed the Inflation Discount Act, which hiked spending on quite a lot of lefty priorities resembling inexperienced power subsidies and taxpayer-funded well being care. Analysts on the Penn Wharton Finances Mannequin calculated that the invoice would marginally enhance inflation over the following decade moderately than, nicely, cut back it.

Trump, in the meantime, has responded to standard anger about inflation by calling for extra tariffs and for lowering the Federal Reserve’s political independence. Binder says that is a mistake. When inflation unleashes anger that the political course of channels into doubtful fast fixes, that is precisely why an unbiased central financial institution with a value stability mandate issues.

“If we left it to elected officers, there would all the time be extreme strain for inflationary insurance policies,” she says. “The Fed usually has to take actions which might be politically unpopular within the quick run to protect value stability within the longer run.”

For the reason that Nineteen Eighties, inflation management has been one of many Fed’s core duties. No matter what different issues libertarians might need with the central financial institution, it is troublesome to argue that it did not do an honest job of conserving inflation low for a number of a long time. Bear in mind: One of many causes individuals appear to be so bothered by inflation charges between 3 % and 4 % is that inflation averaged nicely beneath 2 % for therefore lengthy.

“Inflation, as soon as uncontrolled, lasts just a few years. This fosters the concept that technocratic establishments just like the Fed simply aren’t superb at their jobs and haven’t got management. Having known as inflation ‘transitory’ and stated it might be over in months provides to this,” says Bourne. However politicizing the Federal Reserve and giving presidents extra management over rates of interest “could be manner worse,” he provides.

As a substitute, elected officers within the legislative and govt branches ought to deal with what they’ll management. Extreme spending that depends on multitrillion-dollar deficits (a lot of which is financed by the Federal Reserve’s willingness to purchase Treasury bonds) makes inflation extra doubtless sooner or later—and harder to comprise within the current. If democracy is poorly outfitted to cope with inflation, that is in the end an argument for why America’s leaders should resist the siren calls of stimulus spending within the first place. As soon as unleashed, inflation is troublesome to tame and can unpredictably disrupt social and political cohesion, resulting in but extra poor coverage.

There could also be no simple manner out. In a letter to shareholders in early April, JPMorgan Chase CEO Jamie Dimon warned of “ongoing considerations about persistent inflationary pressures.” Dimon, one of many world’s most influential bankers, urged his shareholders and workers to organize for a prolonged battle in opposition to larger costs, it doesn’t matter what the official inflation stats say every month.

“Immediately there may be large curiosity in month-to-month inflation knowledge, though it appears to me that each long-term pattern I see will increase inflation relative to the final 20 years,” he wrote. “Large fiscal spending, the trillions wanted every year for the inexperienced financial system, the remilitarization of the world and the restructuring of world commerce—all are inflationary.”

Søren Kierkegaard, the nineteenth century thinker whom Biden has a penchant for quoting in stump speeches, as soon as wrote that there are two methods to be fooled. “One is to consider what is not true, and the opposite is to refuse to consider what’s.”

In terms of inflation, our political leaders appear responsible of each errors. For the higher a part of 20 years, politicians in each events have acted like inflation had been completely tamed, that low rates of interest meant that borrowing was low-cost and simple, and that it appeared there could be no penalties for hovering deficits. This was not true.

Now each candidates for president appear to refuse to see what is true. Inflation just isn’t a passing or transitory concern, and it isn’t an issue to be solved with bumper-sticker speaking factors or by scapegoating it away. America’s ongoing battle with inflation is the story of the 2024 election, and it might very nicely be the story of 2025 and 2026 too. It ought to function a warning for the following era of political leaders: Unleash this monster at your individual danger.